Introduction

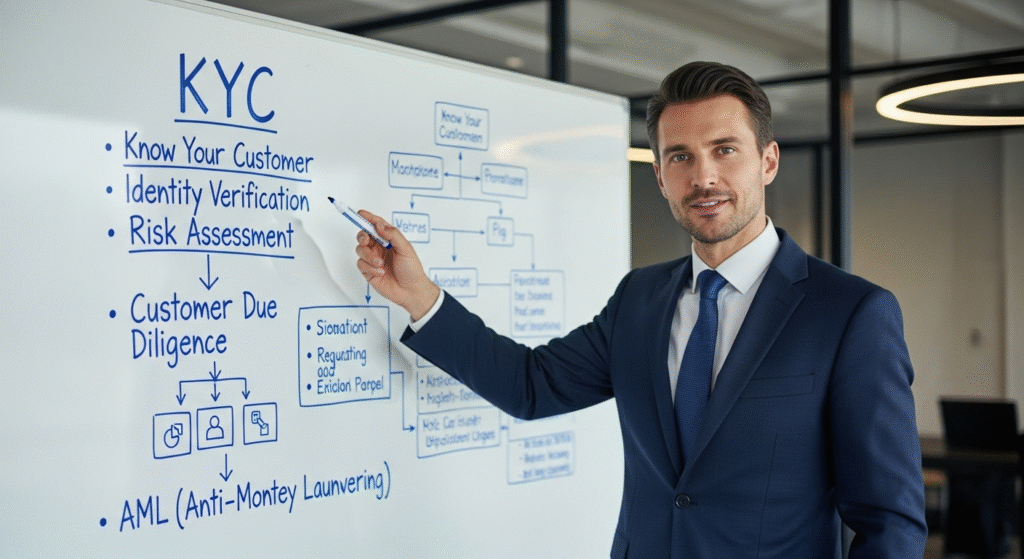

In today’s digital-first economy, every transaction tells a story — and regulators want to know exactly who’s behind it. That’s where KYC meaning (Know Your Customer) becomes essential. KYC is more than paperwork or formality; it’s the process businesses use to verify client identities, detect fraud, and comply with Anti-Money Laundering (AML) laws.

In the United Arab Emirates (UAE), KYC has taken center stage as the country strengthens its compliance frameworks to align with international standards set by the Financial Action Task Force (FATF) (FATF, 2024). Whether your business operates in fintech, banking, real estate, or crypto, understanding how KYC rules apply to you can protect your operations and reputation.

This post takes you on a complete journey:

- What’s changing in fintech, banking, and crypto.

- Why KYC is expanding to real estate and other non-financial sectors.

- How to choose the right KYC service package tailored to your industry.

Let’s start where most businesses feel the pressure first — in digital finance.

KYC Meaning for Fintech, Banking & Crypto: What Changes?

Understanding KYC Meaning in the Digital Financial Era

KYC used to mean collecting ID documents and utility bills. Today, it’s much more dynamic.

In fintech, onboarding is almost entirely digital — customers expect to open accounts or verify identities in minutes. To make that possible, companies rely on eKYC (electronic KYC) systems that verify IDs, biometrics, and databases instantly while ensuring compliance with UAE’s Central Bank regulations.

For banks, KYC compliance remains a top priority. Financial institutions are required to verify not just identity but also the source of funds and purpose of transactions. In the UAE, banks must follow clear Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) procedures under the Federal Decree-Law No. 20 of 2018 on AML and Counter-Terrorism Financing.

In the crypto space, regulators have moved swiftly. The Virtual Assets Regulatory Authority (VARA) now requires virtual asset service providers (VASPs) to perform strict KYC checks before onboarding users or executing trades (VARA, 2023). That means crypto firms must collect and verify personal data while keeping it secure and auditable.

The meaning of KYC has evolved into a cornerstone of trust and transparency across digital finance.

Why KYC Is Critical to Trust, Security & Risk Management

In 2023 alone, global penalties for AML, KYC and customer-due-diligence failures reached approximately $6.6 billion, reflecting the highest year-on-year increase ever recorded (Fenergo, 2024).

| Benefit | Description |

| Early Detection of Risks | Strong KYC processes enable businesses to identify and block suspicious clients or transactions before they lead to financial loss or regulatory breaches. |

| Regulatory Compliance | Effective KYC controls help companies meet the UAE’s strict Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) reporting requirements, reducing exposure to heavy fines and penalties. |

| Customer Trust & Reputation | Transparent and secure verification practices enhance credibility and foster long-term relationships built on trust and ethical conduct. |

At MCompliance, we’ve seen firsthand how proactive KYC systems prevent issues long before they escalate. When a business understands its clients, it’s not just compliant — it’s confident.

Key Regulatory Updates Impacting Fintech & Crypto Firms in UAE

The UAE continues to refine its AML/KYC framework to meet FATF expectations and strengthen the local financial ecosystem. Key updates include:

| Regulatory Requirement | Summary |

| Mandatory KYC Verification | All individuals and entities engaging in financial or virtual asset transactions must undergo full Know Your Customer (KYC) verification before any activity or onboarding is permitted. |

| Ongoing Monitoring of High-Risk Accounts | Businesses must continuously review and monitor transactions involving high-risk clients — including Politically Exposed Persons (PEPs) — to detect and report unusual or suspicious activities. |

| Record-Keeping Obligations | Companies are required to maintain KYC and transaction records for at least five years after the end of a client relationship, ensuring full traceability and audit readiness. |

For fintech and crypto companies, these changes mean compliance can’t be an afterthought. Systems must be built to detect anomalies, manage risk, and report suspicious activity in real time.

The message is clear: effective KYC isn’t a regulatory burden — it’s a business advantage.

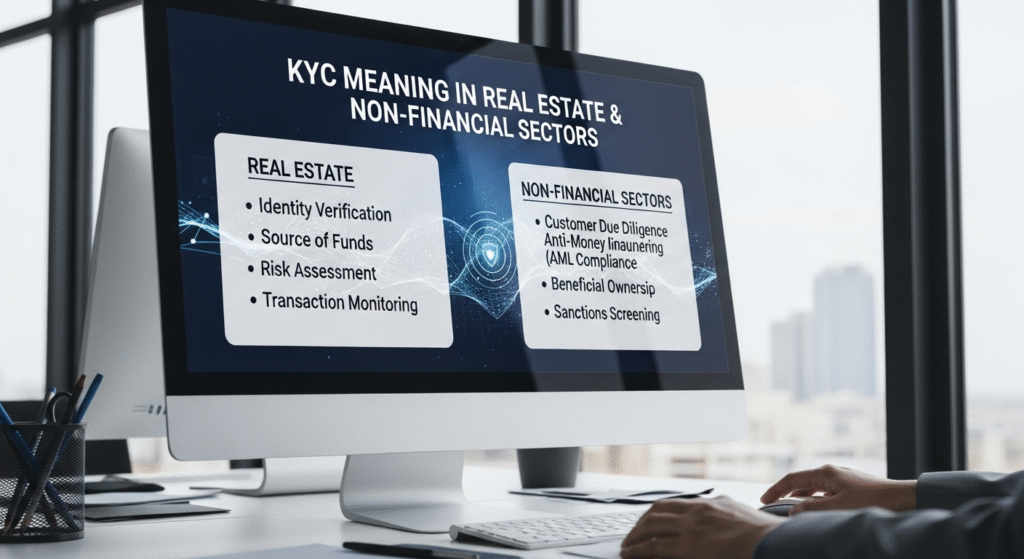

KYC Meaning in Real Estate & Non-Financial Sectors: What to Watch

How KYC Applies to Real Estate, Legal, and Corporate Service Providers

Until recently, KYC rules mostly targeted banks. But that’s changed. In the UAE, Designated Non-Financial Businesses and Professions (DNFBPs) — including real estate brokers, law firms, and corporate service providers — must now follow similar AML/KYC obligations.

For example:

- Real estate developers must verify the source of funds for property buyers.

- Law firms and consultants must identify the ultimate beneficial owner (UBO) of client entities.

- Corporate service providers must maintain detailed client records and conduct periodic risk assessments.

These measures aim to prevent the misuse of UAE’s thriving real estate and business formation sectors for money laundering. Understanding KYC meaning within your industry ensures compliance and safeguards your company’s integrity.

Red Flags and Due Diligence Requirements for DNFBPs

KYC is not only about verification; it’s about vigilance. According to the UAE Ministry of Economy’s 2024 Practical Guide for DNFBPs, businesses should be alert to indicators such as unusually large cash or high-value property transactions, customers unwilling to provide identity documentation, and opaque or complex ownership structures that may conceal the ultimate beneficial owner.

When such patterns arise, companies must apply Enhanced Due Diligence (EDD) and, if necessary, report suspicious activity. Implementing a risk-based KYC approach helps non-financial firms protect their reputation and comply with the Executive Office of Anti-Money Laundering and Counter Terrorism Financing (EO AML/CTF) guidelines.

How Businesses Can Future-Proof Their KYC Framework

Regulations evolve — and so should compliance systems.

By investing in RegTech solutions, businesses can automate verification, monitor transactions in real time, and reduce the burden on compliance teams.

Future-ready KYC frameworks often include:

| KYC Innovation | Business Advantage |

| Digital Onboarding with Secure ID Verification | Enables clients to submit identification documents remotely through encrypted platforms, ensuring faster, compliant onboarding while reducing manual errors. |

| Automated Risk Scoring for Customer Profiles | Uses AI-driven analytics to assess customer risk levels instantly, helping compliance teams prioritize reviews and flag suspicious behavior efficiently. |

| Centralized Audit Trails for Easy Reporting | Creates a unified, transparent record of all KYC actions and customer interactions, simplifying regulatory reporting and internal audits. |

Companies that stay ahead of compliance updates not only avoid fines — they gain a competitive edge by demonstrating transparency and operational maturity.

KYC Meaning – Industry-Tailored Service Packages: Choose the One for You

Why Industry-Tailored KYC Services Drive Compliance Success

Different industries face different risks. A fintech startup’s compliance needs are not the same as a real estate brokerage’s. That’s why MCompliance provides industry-tailored KYC and AML services designed around each sector’s specific regulatory requirements.

Our approach ensures that every business — from crypto exchanges to law firms — meets local and international compliance expectations without overcomplicating operations. Tailored KYC programs mean you:

- Save time through automation and efficient onboarding.

- Stay fully aligned with UAE’s latest AML directives.

- Build lasting confidence with clients and regulators alike.

What’s Included in MCompliance’s KYC Service Packages

Our tailored solutions include:

| Service Component | What It Delivers |

| Digital KYC Setup | Implementation of automated identity verification systems and secure digital onboarding tools to streamline client verification and reduce fraud risks. |

| Policy Development | Expert drafting and updating of AML/KYC policies and manuals aligned with UAE Central Bank and VARA compliance standards. |

| Staff Training | Practical, hands-on training programs to equip internal teams with current regulatory knowledge and best practices in AML and KYC operations. |

| Ongoing Audits | Regular compliance audits, gap analyses, and risk assessments to ensure continuous improvement and long-term regulatory readiness. |

Every package is built to grow with your business — ensuring compliance is seamless, efficient, and future-proof.

Case Example – How a UAE Fintech Improved Compliance Efficiency

A Dubai-based fintech client partnered with MCompliance to streamline its KYC workflow.

In just three months, they:

- Reduced onboarding time by 40%.

- Improved verification accuracy to 98%.

- Passed their first Central Bank compliance audit with zero violations.

By integrating a customized KYC system, the company not only met regulatory standards but also improved customer satisfaction and investor confidence.

Conclusion – Strengthen Your KYC Compliance Today

As KYC requirements expand across industries, staying compliant is not just about avoiding penalties — it’s about building trust and resilience. Whether you operate in banking, crypto, real estate, or corporate services, having a strong KYC system means your business is ready for the future.

With years of experience in regulatory compliance, MCompliance helps UAE businesses implement efficient, tailored KYC frameworks that protect operations, enhance reputation, and ensure peace of mind.

Call to Action:

Stay ahead of compliance challenges.

Contact MCompliance today to discover a KYC and AML solution built specifically for your industry.

Frequently Asked Questions

1. What does KYC mean in the UAE?

KYC (Know Your Customer) is the process of verifying customer identity and assessing risk to prevent money laundering and financial crime.

2. Who must comply with KYC regulations in the UAE?

Banks, fintech companies, DNFBPs, and corporate service providers operating in the UAE must follow KYC requirements.

3. What documents are required for KYC in the UAE?

Common documents include Emirates ID or passport, proof of address, trade license, and ownership or UBO details.

4. What is the difference between CDD and EDD?

CDD is standard identity verification, while EDD involves enhanced checks for high-risk customers or transactions.

5. What happens if a business fails to comply with KYC?

Non-compliance can result in fines, regulatory action, reputational damage, and business restrictions.

For more information on Regulatory Compliance, please visit these links.

- The Impact of Weak Internal Controls on Business Reputation

- Why Financial Crime Compliance Is More Critical Than Ever in 2025

- What is KYC and Why It Matters for Businesses in the UAE

- Understanding the DIFC Data Protection Landscape and Why It Matters

- Understanding KYC & AML: Risk Assessment Steps That Safeguard Your Business