In today’s fast-moving financial environment, strong internal controls are not just a box-ticking exercise — they are the foundation of trust and resilience. Businesses that fail to identify and manage control risks effectively can face severe consequences. When proper compliance measures are missing, the damage goes far beyond fines — reputational harm, loss of customer trust, and operational setbacks can leave lasting scars that are difficult to repair.

In the UAE, regulators such as the Central Bank, the Dubai Financial Services Authority (DFSA), and Abu Dhabi Global Market (ADGM) have raised the bar for compliance standards. Businesses that cannot demonstrate robust internal controls risk being penalized and sidelined in a competitive market.

This article explores why weak controls put your reputation at risk, how to control risks in AML programs, and how professional compliance audits and monitoring can safeguard your business.

Why Internal Controls Are Critical for Business Reputation

What Are Internal Controls in Compliance?

Internal controls are the policies, procedures, and systems that help organizations detect and prevent misconduct, fraud, and regulatory breaches. In a compliance context, they serve as the defense line that protects both customers and stakeholders.

For example, customer due diligence, transaction monitoring, and suspicious activity reporting are all forms of internal controls. They ensure businesses are not unintentionally enabling financial crime.

Real Consequences of Weak Internal Controls

Weak internal controls can lead to serious problems:

- Financial penalties: In 2022, the UAE Central Bank imposed penalties on several banks for failing to meet anti-money laundering (AML) standards (Central Bank of the UAE, 2022).

- Reputational damage: Once customers or investors lose trust, rebuilding confidence is far more costly than the original fine.

- Operational disruption: Poor compliance can result in frozen accounts, terminated partnerships, and restrictions from international networks.

Reputational Damage Is Harder to Fix Than Fines

Studies show that when a company’s reputation is damaged by crises — including regulatory or compliance failures — it often suffers a sustained drop in shareholder value, depending on how well leadership responds (Oxford Metrica / PwC, 2020).

In the UAE, where reputation and trust are key drivers of growth, even a single incident of non-compliance can make investors and partners hesitant to do business.

How to Control Risks in AML Programs and Prevent Penalties

As regulators tighten their grip, businesses need to be proactive. This section explains how to control risks by strengthening AML programs and ensuring compliance.

Why AML Programs Are the Core of Compliance

An AML program is the framework businesses use to prevent money laundering, terrorist financing, and financial fraud. In the UAE, regulators expect all institutions — not just banks — to establish comprehensive AML frameworks.

Without a solid AML program, companies expose themselves to risks that can lead to regulatory action and public scrutiny.

Key Ways to Control Risks in AML Programs

| Risk Control Area | Description |

| Customer Due Diligence (CDD) & Enhanced Due Diligence (EDD) | Verifying customer identity and applying extra checks for high-risk clients. |

| Transaction Monitoring | Tracking and analyzing transactions to identify unusual or suspicious activities in real time. |

| Suspicious Activity Reporting | Escalating red flags to authorities promptly to demonstrate compliance. |

| Independent Audits | Conducting regular reviews to detect gaps and ensure corrective actions are taken. |

Best Practices for Preventing Penalties

- Use of RegTech solutions:Automation and AI-driven systems improve monitoring and reduce human error.

- Employee training: Staff who understand AML responsibilities are more likely to flag risks early.

- Building a compliance culture: Leaders must make compliance part of daily operations, not an afterthought.

UAE-Specific Regulatory Expectations

In the UAE, the Central Bank has repeatedly issued statements emphasizing that weak AML frameworks will not be tolerated. In fact, the United Nations Office on Drugs and Crime (2020) estimates that up to 5% of global GDP — nearly USD 2 trillion — is laundered each year. Regulators in the UAE are determined to ensure the nation is not a channel for this illicit activity.

Businesses must align not only with local laws but also with global standards such as FATF guidelines to avoid penalties and reputational harm.

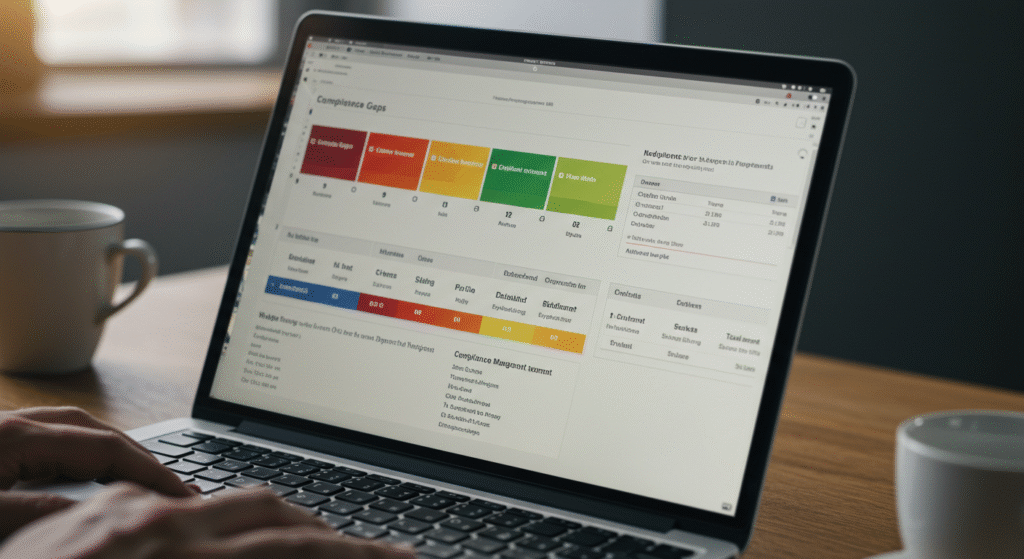

Compliance Gaps and Their Business Impacts

| Compliance Gap | Description | Business Impact |

| Weak KYC Processes | Incomplete or inconsistent customer onboarding checks | Exposure to fraud, regulatory penalties, loss of banking relationships |

| Poor Transaction Monitoring | Failure to flag unusual or suspicious activity in real time | Higher risk of being used for money laundering or terrorist financing |

| Lack of Regular Compliance Audits | Gaps in policies and procedures go undetected | Regulatory sanctions, reputational damage, increased scrutiny from authorities |

| Insufficient Staff Training | Employees unaware of AML/KYC obligations | Higher likelihood of human error, failure to report suspicious activity |

| Outdated Technology | Legacy systems unable to meet modern compliance standards | Inefficiency, higher operational costs, vulnerability to cyber-enabled financial crime |

Get Professional AML Audit & Monitoring Services Today

Even businesses with strong AML frameworks can struggle to keep up with evolving regulations. This is where professional expertise makes the difference.

Why Professional Audits Are Essential

Independent audits help organizations spot blind spots they may not see internally. Auditors not only test systems but also provide actionable recommendations to prevent compliance failures before regulators intervene.

Why Choose MCompliance as Your Partner

At MCompliance, we understand the regulatory landscape of the UAE. Our certified compliance specialists provide:

- Independent AML audits tailored to your industry.

- Ongoing monitoring to ensure you remain compliant year-round.

- Customized advisory services to strengthen your compliance culture.

With years of combined expertise, our team helps organizations stay ahead of regulatory changes while safeguarding their reputation.

How Our Services Safeguard Your Reputation

Partnering with MCompliance ensures you have:

- Customized frameworks designed for your business model.

- Proactive compliance monitoring that reduces the risk of penalties.

- Peace of mind, knowing your reputation is protected in a competitive market.

Frequently Asked Questions (FAQ)

1: What are internal controls in compliance?

Internal controls are systems and processes that help businesses prevent fraud, misconduct, and regulatory breaches.

2: How do weak internal controls damage business reputation?

They create openings for financial crime, which can lead to fines, regulatory action, and a loss of customer and investor trust.

3: What does it mean to control risks in AML programs?

It means using strong frameworks like due diligence, monitoring, and audits to reduce exposure to money laundering risks.

4: Why are UAE businesses facing stricter compliance penalties?

The UAE is committed to meeting global FATF standards, so regulators impose heavy penalties on non-compliant institutions.

5: How can MCompliance help prevent compliance failures?

We provide AML audits, monitoring, and advisory services to help businesses meet UAE regulations and avoid penalties.

Conclusion & Call to Action

Weak internal controls can harm a business faster than most realize. Fines may sting, but the reputational fallout can leave lasting damage. By investing in strong AML programs and working with compliance experts, organizations can control risks, prevent penalties, and safeguard their reputation.

Don’t wait until regulators flag compliance failures. Contact MCompliance today to schedule a professional AML audit and monitoring service that protects your business from financial crime and reputational harm.

You can explore additional Regulatory Compliance materials at these links:

– Why Financial Crime Compliance Is More Critical Than Ever in 2025

– What is KYC and Why It Matters for Businesses in the UAE

– Understanding the DIFC Data Protection Landscape and Why It Matters

– Understanding KYC & AML: Risk Assessment Steps That Safeguard Your Business

– How Can Regulatory Compliance Benefit from RegTech and Compliance Automation?