KYC (Know Your Customer) has become one of the strongest tools for protecting the financial system across the UAE and the wider GCC. From banks and fintech companies to DNFBPs and corporate service providers, every regulated business now needs a solid KYC program to meet local laws and global expectations. As regulatory demands continue to rise, Arab financial services and similar institutions are strengthening their KYC frameworks to reduce risks, protect customers, and remain ready for audits and inspections.

What Is KYC and Why It Matters for All Regulated Companies

KYC is the process of verifying a customer’s identity and assessing the risk they may pose. This helps businesses prevent financial crimes such as money laundering, fraud, and terrorism financing. In the UAE, regulators expect every licensed business to follow strict rules to keep the financial system safe.

KYC is important because it helps companies:

- Understand who their customers are

- Detect unusual or suspicious activity

- Protect their reputation

- Avoid penalties and regulatory action

KYC and AML controls play a critical role in protecting the financial system. FATF guidance explains that customer due diligence, identification measures, and ongoing monitoring help financial institutions assess and mitigate money laundering and terrorism-financing risks, thereby supporting the integrity and stability of the global financial system (Financial Action Task Force [FATF], 2023).

Core Pillars of KYC

A strong KYC program includes five essential parts:

| Core Pillars | Description |

| 1. Customer Identification | As part of KYC best practices, Arab financial services collect reliable information—such as passports, Emirates IDs, trade licenses, and authorized signatory details—to verify each customer’s identity. |

| 2. Customer Due Diligence (CDD) | Arab financial services apply KYC best practices to determine whether a customer is low, medium, or high risk. This includes identity checks, background screening, and gathering basic customer information. |

| 3. Enhanced Due Diligence (EDD) | Higher-risk customers require deeper checks, such as verifying sources of funds, reviewing corporate structures, and checking for political exposure. |

| 4. Ongoing Monitoring | KYC does not stop after onboarding. Companies must regularly track transactions, update customer profiles, and report unusual behaviors. |

| 5. Record-Keeping | Regulators require businesses to maintain KYC records for several years to support investigations and compliance reviews. |

The UAE Regulatory Landscape

KYC requirements in the UAE are shaped by several authorities, including:

- Central Bank of the UAE (CBUAE)

- Dubai Financial Services Authority (DFSA)

- Abu Dhabi Global Market (ADGM) FSRA

- Ministry of Economy (MOE)

The UAE’s regulatory framework has been updated to align with international standards set by FATF. Since 2023, the authorities have increased supervision, conducted more risk assessments, and carried out enforcement actions across financial and non-financial institutions. In its 2024 Article IV Consultation, the IMF noted that major efforts under the UAE’s national AML/CFT strategy contributed to the country’s removal from enhanced monitoring under FATF, reflecting tangible improvements in the national AML/CFT framework (International Monetary Fund, 2024).

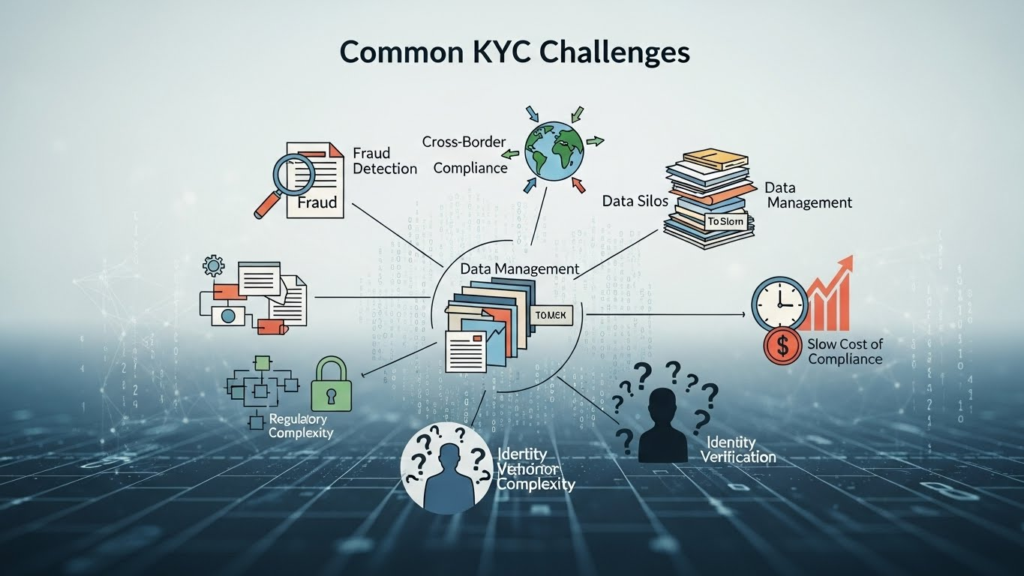

Common KYC Challenges

While KYC is crucial, many regulated companies still face challenges such as:

- Paper-based onboarding

- Inconsistent data collection

- Lack of trained compliance staff

- Difficulty managing high-risk customers

- Limited monitoring tools

These issues can increase risk and lead to regulatory penalties. Understanding them early helps companies build stronger controls.

KYC Best Practices Adopted by arab financial services to Strengthen Compliance

Arab financial services and leading institutions across the region follow proven strategies to strengthen their KYC frameworks. These best practices help reduce errors, improve audit readiness, and maintain compliance with UAE laws.

1. Implementing a Risk-Based Approach

Not all customers carry the same risk. High-risk customers—such as PEPs or businesses with complex structures—require more detailed checks.

A risk-based approach allows companies to focus resources where they matter most. This method also aligns with FATF recommendations and UAE regulatory expectations.

2. Digitizing Customer Onboarding

Digital tools make KYC faster, more accurate, and more compliant. Leading institutions use:

- eKYC identity verification

- Automated document checks

- AML screening tools

- Digital onboarding platforms

These systems reduce manual errors and speed up the customer approval process, leading to better customer experience and stronger compliance outcomes.

3. Strengthening Internal Controls

Strong internal controls ensure that KYC policies are followed consistently. This includes:

- Maker-checker approval processes

- Documented review workflows

- Regular internal audits

- Periodic compliance assessments

Clear governance helps avoid gaps, reduces risk, and ensures that customer files are always audit-ready.

4. Regular Staff Training

KYC rules change often, and the UAE has one of the fastest-growing regulatory environments. Leading organizations train their teams regularly to ensure they understand:

- Updated regulations

- How to identify red flags

- Proper documentation standards

- Correct onboarding procedures

Well-trained staff help avoid costly mistakes and ensure consistent compliance.

5. Strong Ongoing Monitoring Procedures

Monitoring customer behavior is key to identifying suspicious activity. Companies use:

- Automated transaction monitoring

- Alerts and red-flag indicators

- Escalation procedures

- Periodic customer reviews

Monitoring is where many businesses fall short, so a clear, reliable process is essential.

6. Effective Recordkeeping

Documents must be complete, well-organized, and available during regulatory inspections. Proper recordkeeping reflects a strong compliance culture and reduces the risk of penalties.

7. Collaboration Between Departments

KYC is not only the compliance team’s responsibility. Collaboration between compliance, operations, legal, finance, and IT ensures smooth processes and more reliable data.

KYC Program Setup, Outsourcing & Ongoing Monitoring Services

Many UAE companies choose to outsource KYC to experts. This gives them access to trained compliance professionals without the cost of hiring and managing a full in-house team.

At MCompliance, we support regulated companies across the UAE with complete KYC solutions built by industry experts with years of experience.

Why Companies Outsource KYC

Outsourcing can help businesses:

- Reduce overhead costs

- Improve onboarding speed

- Access specialist expertise

- Strengthen compliance controls

- Prepare for regulatory inspections

- Focus on core business operations

A 2023 survey by Guidehouse and Compliance Week found that 74% of financial institutions outsourcing parts of their compliance and financial-crime functions reported improved effectiveness in their compliance programs (Guidehouse & Compliance Week, 2023).

Our KYC Services Include

| Service | Description / Purpose |

| Full KYC Program Setup | Establish a complete KYC framework tailored to your organization’s needs. |

| KYC Policy Development | Draft clear policies and procedures to ensure regulatory compliance. |

| CDD and EDD Support | Provide guidance and execution support for Customer Due Diligence and Enhanced Due Diligence processes. |

| Customer Onboarding Assistance | Help streamline and verify new customer onboarding while maintaining compliance standards. |

| Ongoing Monitoring | Continuously track customer transactions and behaviors to identify suspicious activity. |

| Risk Scoring Model Development | Develop models to assess customer risk and prioritize compliance resources effectively. |

| Screening and Reporting | Conduct sanctions, PEP, and adverse media screening, and produce compliance reports. |

| Staff Training and Advisory | Train employees on KYC requirements and provide expert advisory support for ongoing compliance. |

Benefits of Working With MCompliance

With deep regional expertise and a proven track record, MCompliance helps businesses:

- Build robust KYC frameworks

- Reduce compliance risk

- Improve audit outcomes

- Stay aligned with UAE regulations

- Scale efficiently

Who We Support

Our services support:

- Banks

- FinTechs

- Payment service providers

- DNFBPs

- MSBs

- Brokerage and investment firms

- Corporate service providers

Final Call to Action — Strengthen Your KYC Framework Today

A strong KYC system is essential for maintaining compliance, protecting your business, and supporting long-term growth. Whether you need help setting up a full KYC program, improving existing processes, or outsourcing ongoing monitoring, MCompliance is ready to support you with expert, UAE-focused solutions.

Contact us today to speak with a compliance expert and strengthen your KYC framework with confidence.

Frequently Asked Questions

1. What is KYC and why is it important?

KYC (Know Your Customer) is the process of verifying a customer’s identity and assessing potential risks. It is crucial for preventing money laundering, fraud, and terrorism financing, and for ensuring regulatory compliance.

2. Who needs to comply with KYC regulations in the UAE?

All regulated financial institutions, fintech companies, DNFBPs (Designated Non-Financial Businesses and Professions), and corporate service providers must comply with KYC rules in the UAE.

3. What are the main components of a KYC program?

A strong KYC program includes Customer Identification, Customer Due Diligence (CDD), Enhanced Due Diligence (EDD) for high-risk customers, Ongoing Monitoring, and Record-Keeping.

4. How can outsourcing KYC help my business?

Outsourcing KYC can reduce operational costs, ensure expert compliance support, improve onboarding speed, strengthen internal controls, and help maintain regulatory compliance.

5. What services does MCompliance offer for KYC?

MCompliance provides full KYC program setup, policy development, CDD/EDD support, customer onboarding assistance, ongoing monitoring, risk scoring models, screening and reporting, and staff training/advisory.

To learn more about Regulatory Compliance, you may refer to these links provided.

- The Impact of Weak Internal Controls on Business Reputation

- Why Financial Crime Compliance Is More Critical Than Ever in 2025

- What is KYC and Why It Matters for Businesses in the UAE

- Understanding the DIFC Data Protection Landscape and Why It Matters

- Understanding KYC & AML: Risk Assessment Steps That Safeguard Your Business