In today’s fast-paced FinTech world, innovation moves at lightning speed. But with every new app, payment gateway, and data exchange platform comes one growing challenge — managing risk. For financial institutions operating in the UAE, particularly within the Dubai International Financial Centre (DIFC), embedding a strong risk management process is no longer just good practice — it’s essential for compliance, reputation, and sustainable growth.

This blog explores how modern FinTech and banking firms can protect their operations from evolving threats by adopting a structured risk management process that aligns with UAE regulatory frameworks and international data protection standards.

Emerging Threats in FinTech & Data Protection

The FinTech Revolution and Its Compliance Challenges

The FinTech sector is transforming how people move, store, and manage money. The UAE, led by the DIFC and Abu Dhabi Global Market (ADGM), has become a regional leader in digital finance innovation. Yet, as technology evolves, so do the risks. Financial platforms now manage massive amounts of personal and transactional data, making them prime targets for cyberattacks and compliance breaches.

According to DFSA, firms authorised in the DIFC must establish a governance and risk-management framework that enables them to identify, assess, monitor and mitigate operational and cyber risks as appropriate for their size, scale and complexity. This expectation makes risk management not only a compliance requirement but a strategic necessity for business continuity.

Key Emerging Threats in the FinTech Risk Landscape

The FinTech risk landscape in the UAE has expanded rapidly in recent years. Common challenges include:

| Risk Type | Description |

| Cybersecurity Breaches | Vulnerabilities arising from cloud-based systems, open banking APIs, and digital integrations that may expose sensitive customer or transaction data. |

| Third-Party Risks | Compliance and operational exposure resulting from reliance on vendors, outsourcing partners, or SaaS providers without adequate oversight or due diligence. |

| Operational Risks | Issues such as inaccurate data, process failures, or system downtime that disrupt service continuity and impact financial stability. |

| Regulatory & Compliance Risks | Challenges driven by evolving UAE laws and frameworks — including DIFC and ADGM regulations — that require ongoing monitoring and policy updates. |

Each of these threats can harm a company’s financial health and customer trust if left unmanaged. The solution lies in applying a well-defined, proactive risk management process that anticipates and mitigates vulnerabilities before they escalate.

Why Data Protection Is Central to FinTech Sustainability

Data is the new currency of the digital economy — and protecting it is vital for earning customer trust. The DIFC Data Protection Law No. 5 of 2020, aligned with the EU’s General Data Protection Regulation (GDPR), establishes clear obligations on how personal data must be collected, processed, and stored.

A strong risk management process integrates these data protection principles, ensuring that privacy controls are built into every stage of operations — from customer onboarding to cloud storage.

According to the IAPP, organisations that embed data protection and transparent privacy practices strengthen their governance, reduce regulatory risk, and position themselves to stand out in terms of brand and stakeholder trust

Embedding the Risk Management Process in FinTech & Banking Operations

What the Risk Management Process Looks Like in Practice

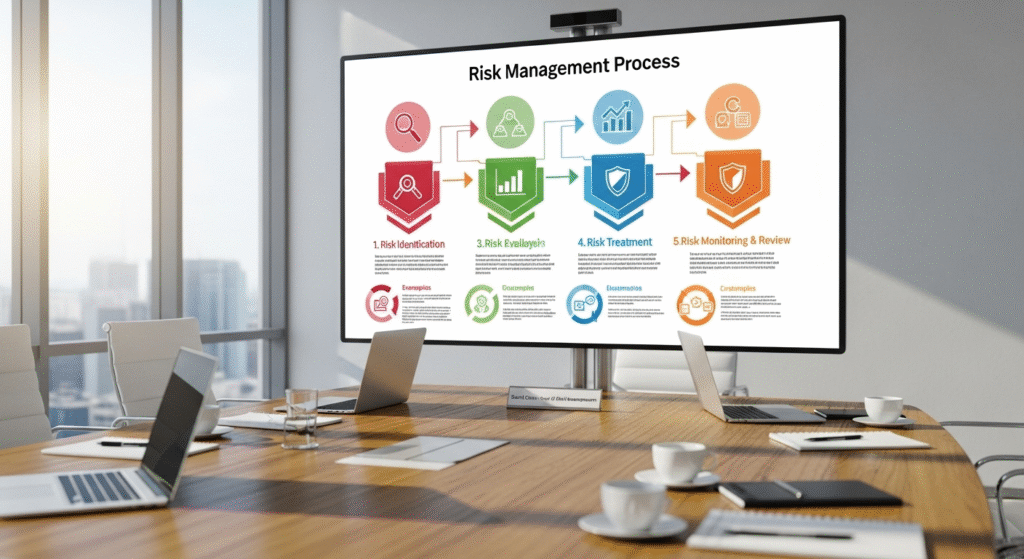

At its core, the risk management process is a systematic approach to identifying, analyzing, and responding to risks that could impact business objectives. For FinTech and banking organizations, it typically follows five key stages:

| Stage | Purpose |

| 1. Risk Identification | Detecting potential risks in operations, technology, data handling, and regulatory compliance. |

| 2. Risk Assessment | Measuring the likelihood and impact of each risk to prioritize responses. |

| 3. Risk Mitigation | Implementing controls, policies, or encryption to reduce identified risks. |

| 4. Risk Monitoring | Continuously reviewing performance of mitigation measures through audits or metrics. |

| 5. Risk Reporting | Documenting and communicating findings to regulators, management, and stakeholders. |

This structured approach ensures that FinTech organizations remain agile yet compliant, capable of adapting to both regulatory requirements and market dynamics.

Integrating Data Protection Into the Risk Management Framework

Data protection is not a separate process — it is a critical component of modern risk management. Incorporating privacy controls early helps organizations align with UAE data laws and global best practices.

Practical steps include:

- Conducting data mapping to track where information resides and flows.

- Performing Privacy Impact Assessments (PIAs) before launching new products.

- Maintaining a Record of Processing Activities (ROPA) for transparency.

- Applying encryption and access controls to protect sensitive information.

When executed correctly, these measures create a culture of compliance and accountability that reassures both regulators and customers.

Regulatory Expectations and Industry Best Practices

The UAE’s regulatory landscape for FinTech continues to evolve rapidly. Organizations must stay ahead by aligning with frameworks such as:

- DFSA’s Operational Risk Framework for financial institutions.

- Central Bank of the UAE Risk Management Guidelines for licensed entities.

- DIFC Commissioner of Data Protection’s rules on lawful data processing and international transfers.

Following these standards not only prevents penalties but also signals organizational maturity — an important differentiator in the competitive FinTech space.

Industry reports show that organisations with structured risk and compliance programmes report measurably fewer incidents and faster audit responses; formal frameworks improve governance and reduce regulatory exposure (Navex, 2024; Veritas, 2023).

FinTech-Ready Risk Management Process Services — What to Choose

Key Factors When Choosing a Compliance Partner

Selecting the right partner to support your risk management process is critical. Consider providers who:

- Have proven experience in UAE regulatory compliance.

- Understand FinTech operations, cross-border data flow, and digital ecosystems.

- Offer customized frameworks for your risk profile and sector.

- Provide training and technology integration to maintain ongoing compliance.

An expert compliance partner acts as both a strategic advisor and an operational ally — helping your organization grow safely in a tightly regulated environment.

How MCompliance Supports Your Risk Management Journey

At MCompliance, we specialize in building resilient compliance ecosystems for FinTechs, banks, and financial institutions across the UAE. Our team provides:

- Comprehensive risk assessments aligned with DFSA and DIFC requirements.

- Data protection program design, including policies and reporting mechanisms.

- Operational risk audits and continuous monitoring support.

- Employee compliance training to strengthen internal culture and awareness.

With over years of regional experience, MCompliance bridges the gap between regulatory complexity and practical implementation — ensuring your risk management framework is both compliant and efficient.

Benefits of Working with a Qualified Compliance Partner

Partnering with a seasoned compliance firm delivers measurable value:

- Reduced exposure to regulatory fines and reputational harm.

- Improved governance and board confidence through transparent reporting.

- Enhanced operational resilience through continuous monitoring.

- Long-term savings by preventing costly risk events and data breaches.

MCompliance enables businesses to focus on innovation and growth, knowing their compliance foundation is secure, auditable, and future-ready.

Secure Your FinTech Compliance Advantage

In a financial landscape driven by innovation and oversight, the organizations that thrive are those that embed compliance into their DNA. A well-executed risk management process helps FinTechs and banks not only meet legal obligations but also build lasting trust with clients, regulators, and partners.

Don’t wait until a regulatory incident forces change — act proactively.

Contact MCompliance today to discover how our tailored risk management and data protection solutions can safeguard your operations and elevate your compliance maturity.

Frequently Asked Questions (FAQs)

1. What is the risk management process in FinTech?

The risk management process in FinTech involves identifying, assessing, mitigating, monitoring, and reporting potential risks that could impact financial operations, data security, or compliance. It provides a structured way for organizations to stay resilient and aligned with both UAE and international regulations.

2. Why is risk management important for financial institutions in the UAE?

In the UAE, financial institutions are governed by strict regulatory frameworks from authorities such as the Dubai Financial Services Authority (DFSA) and the Central Bank of the UAE. Implementing a strong risk management process helps prevent non-compliance, minimize operational losses, and maintain stakeholder and customer trust.

3. How does data protection relate to risk management?

Data protection is an essential part of effective risk management. By ensuring that personal and financial data are handled lawfully and securely, organizations comply with the DIFC Data Protection Law and international standards like the GDPR, reducing both regulatory and reputational risk.

4. What are the main challenges in implementing risk management frameworks?

Common challenges include outdated IT systems, limited staff awareness, third-party dependencies, and frequent regulatory updates. These factors can make it difficult to maintain consistent compliance without expert support or automated systems.

5. How can FinTech firms in the UAE stay compliant with DFSA and DIFC requirements?

FinTech firms should conduct regular risk assessments, implement clear data handling policies, provide employee training, and work closely with qualified compliance professionals. Partnering with specialists like MCompliance ensures that frameworks are current, comprehensive, and aligned with local regulations.

The following links provide additional insight into Regulatory Compliance:

– Why Financial Crime Compliance Is More Critical Than Ever in 2025

– What is KYC and Why It Matters for Businesses in the UAE

– Understanding the DIFC Data Protection Landscape and Why It Matters

– Understanding KYC & AML: Risk Assessment Steps That Safeguard Your Business

– How Can Regulatory Compliance Benefit from RegTech and Compliance Automation?