In today’s fast-changing financial world, trust is everything. Customers want to know their money is safe, regulators demand stronger oversight, and businesses need tools to protect against fraud and crime. One of the most effective ways to build this trust is through Know Your Customer (KYC). By following a structured compliance approach—often aligned with the 5 steps to risk assessment—organizations can better evaluate customer profiles, spot unusual activity, and reduce exposure to financial crime.

For companies in the UAE—especially in banking, fintech, payments, and crypto—KYC is more than a box-ticking exercise. It is a legal requirement, a business safeguard, and a driver of long-term growth. But many organizations still struggle with how to build effective KYC processes. That’s where using the 5 steps to risk assessment can make a difference.

In this article, we’ll explore:

- Why KYC matters in modern business.

- How the 5 steps to risk assessment can improve KYC processes.

- How professional compliance services, like those offered by MCompliance, provide customized solutions for businesses in the UAE.

Why KYC Matters in Today’s Regulatory Landscape

Regulators across the world are tightening rules to fight financial crime. The Financial Action Task Force (FATF) sets global AML/CFT standards via its 40 Recommendations, while the Central Bank of the UAE enforces detailed local AML/CFT regulations, including Federal Decree-Law No. 20 of 2018, recent guidance for Licensed Financial Institutions in 2023, and ongoing oversight for sectors such as virtual assets. (Central Bank of the UAE, 2023; FATF, 2025). KYC is central to these efforts.

KYC is not just about following the law. It also helps businesses:

- Reduce fraud and identity theft.

- Build stronger relationships with customers.

- Prepare for international expansion, where compliance is essential.

Failing to implement strong KYC controls can lead to severe consequences. In 2022, financial institutions worldwide were fined nearly US$5 billion for AML, sanctions, and KYC‐related failures — illustrating the cost of weak compliance programs (Fenergo / Financial Times, 2023). These cases highlight the importance of building reliable systems early, especially in growing economies like the UAE.

Common Challenges Businesses Face With KYC

Despite its importance, many businesses in the region face challenges with KYC:

- Onboarding delays: Manual document checks slow down the customer experience.

- Data errors: Inaccurate information can lead to false positives or missed risks.

- High costs: Maintaining compliance teams and technology can be expensive.

- Digital gaps: Businesses often struggle to adapt KYC to online transactions.

These challenges can create frustration for clients, weaken compliance, and expose businesses to regulatory penalties. Fortunately, there is a structured way forward—by applying the 5 steps to risk assessment.

Using the 5 Steps to Risk Assessment to Improve KYC Processes

Risk assessment is the backbone of compliance. It gives businesses a way to identify and manage threats before they become serious problems. When applied to KYC, the 5 steps to risk assessment create a structured framework that makes KYC processes stronger and more efficient.

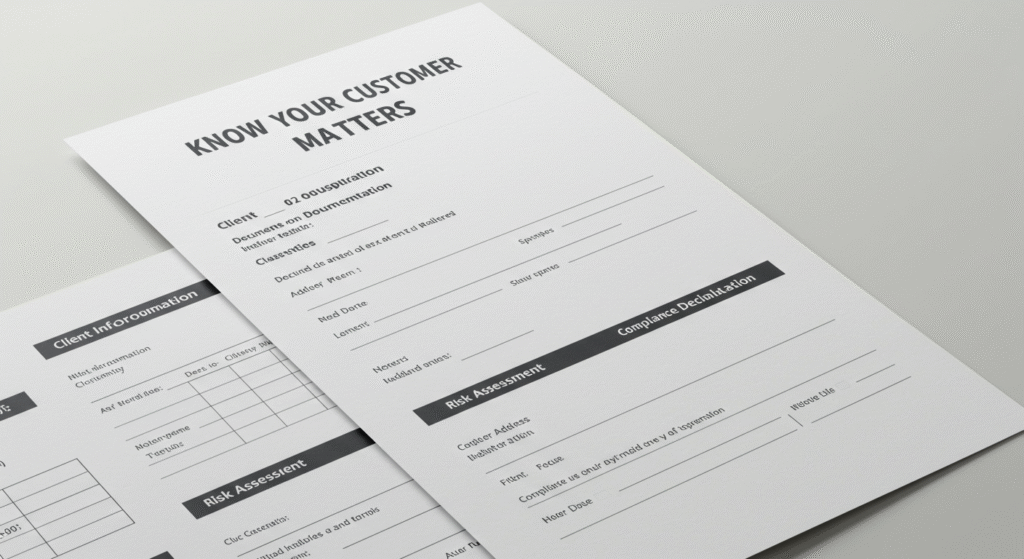

Step 1 – Identify Customer Risk Factors

Not all customers carry the same level of risk. Businesses must first identify factors such as:

- High-risk jurisdictions.

- Industries vulnerable to money laundering (e.g., casinos, crypto exchanges).

- Clients with unusual transaction behavior.

By spotting these risks early, businesses can apply the right level of due diligence.

Step 2 – Assess and Score Risks

Once risks are identified, they should be measured and scored. For example, a politically exposed person (PEP) may require enhanced due diligence, while a local client with a simple profile may only need basic checks.

Scoring risks allows compliance teams to focus resources where they are most needed, balancing efficiency with protection.

Step 3 – Develop Controls and Procedures

After scoring risks, businesses need strong controls in place. This may include:

- Automated document verification systems.

- Screening against global sanctions and watch lists.

- Escalation processes for higher-risk clients.

Clear procedures not only keep risks under control but also show regulators that compliance is taken seriously.

Step 4 – Implement Monitoring Mechanisms

KYC does not end once a customer is onboarded. Ongoing monitoring is essential to detect suspicious activity. This involves:

- Regularly reviewing customer profiles.

- Tracking unusual transactions.

- Updating compliance programs as regulations evolve.

Continuous monitoring helps businesses adapt to new threats and stay aligned with regulatory expectations.

Step 5 – Review and Improve Regularly

The final step is ensuring the system itself stays strong. Businesses should conduct regular audits, review procedures, and train staff to keep up with evolving risks.

This proactive approach prevents weaknesses from going unnoticed and ensures compliance programs remain robust over time.

Summary Table

| Step | Description | Business Impact |

| Step 1 – Identify Risk Factors | Spot high-risk customers, industries, or regions | Prevent onboarding of risky clients early |

| Step 2 – Assess & Score Risks | Assign risk levels based on severity and likelihood | Focus resources on high-risk areas |

| Step 3 – Develop Controls | Establish verification tools, sanctions screening, escalation | Create consistency and satisfy regulators |

| Step 4 – Monitor Ongoing Activity | Track transactions and customer behavior continuously | Detect unusual activity quickly |

| Step 5 – Review & Improve | Conduct audits, update policies, train staff | Keep systems strong and regulator-ready |

KYC & Due Diligence Services: Customized Compliance Support

Even with a solid framework, many businesses find it difficult to manage KYC and risk assessments on their own. Regulations change quickly, technology moves fast, and penalties for mistakes are high. This is where professional compliance support becomes invaluable.

At MCompliance, we provide tailored KYC and due diligence services designed to meet the specific needs of businesses in the UAE. With years of experience, we understand both global standards and local regulatory expectations.

Why Businesses Partner With Compliance Experts

- Save costs by reducing inefficiencies in compliance processes.

- Avoid penalties with regulator-ready frameworks.

- Strengthen systems using proven best practices.

- Free internal teams to focus on business growth rather than admin tasks.

What MCompliance Offers

Our services are built around the needs of each client. We provide:

- Customized KYC onboarding to match your business model.

- Enhanced Due Diligence (EDD) for high-risk clients and industries.

- Compliance training to strengthen internal teams.

- Ongoing monitoring and audit support for long-term protection.

Whether you’re a startup fintech company or an established financial institution, our solutions scale with your needs.

Call to Action

Compliance does not have to be complicated. With the right partner, it becomes a business strength. At MCompliance, we combine global expertise with local insight to deliver reliable, cost-effective compliance support.

Protect your business with customized KYC and due diligence services. Contact MCompliance today to schedule a consultation.

Frequently Asked Questions (FAQ)

1. What is KYC and why is it important for businesses in the UAE?

KYC, or Know Your Customer, is the process of verifying a client’s identity to prevent financial crime. In the UAE, KYC is required under AML/CFT regulations set by the Central Bank. It helps businesses avoid fines, reduce fraud, and build trust with regulators and customers.

2. What are the 5 steps to risk assessment in compliance?

The 5 steps are:

- Identify customer risk factors.

- Assess and score risks.

- Develop controls and procedures.

- Implement monitoring mechanisms.

- Review and improve regularly.

This framework ensures KYC processes remain strong and regulator-ready.

3. How does poor KYC compliance affect businesses?

Weak KYC controls can lead to financial losses, reputational damage, and regulatory penalties. In 2022 alone, global financial institutions paid nearly USD 5 billion in fines for AML and KYC failures (Fenergo, 2023).

4. What industries in the UAE need KYC the most?

While all regulated businesses must follow AML/CFT laws, KYC is especially critical for banks, fintechs, money service providers, insurance companies, real estate firms, and crypto asset service providers.

5. How can MCompliance help my business with KYC?

MCompliance provides customized KYC onboarding, enhanced due diligence, compliance training, and continuous monitoring. With years of expertise, our team ensures businesses meet UAE and international compliance standards

Additional resources on Regulatory Compliance can be found at these links:

– Operational Risk

– Compliance Training Solutions

– What is KYC and Why It Matters for Businesses in the UAE

– How Can Regulatory Compliance Benefit from RegTech and Compliance Automation?

– MCompliance