In today’s fast-changing business world, compliance is more than just a box to check. Across the globe, regulators are cracking down on financial crime, and the UAE is no exception. Authorities such as the Central Bank of the UAE and the Ministry of Economy have made it clear that companies must put in place robust measures to prevent money laundering, fraud, and terrorist financing. A critical part of this effort is ensuring that KYC documents are properly collected, verified, and maintained, as they form the foundation of effective due diligence and compliance programs.

At the heart of these measures lies KYC, or Know Your Customer. This process ensures that businesses verify and understand who they are dealing with before engaging in financial or professional services. Strong KYC frameworks not only meet regulatory obligations but also protect businesses from reputational harm and financial penalties. For companies in the UAE—whether banks, real estate firms, law practices, or other DNFBPs (Designated Non-Financial Businesses and Professions)—KYC is no longer optional. It is a strategic requirement.

Understanding the Basics of KYC in the UAE

What is KYC?

KYC refers to the steps businesses take to verify the identity of their clients. This includes confirming who the customer is, assessing their risk level, and monitoring transactions over time. A solid KYC process helps businesses detect suspicious activity before it becomes a liability.

KYC in the UAE Regulatory Context

In the UAE, KYC requirements are grounded in the Federal Decree Law No. 20 of 2018 on Anti-Money Laundering and Combating Financing of Terrorism, along with Cabinet Decision No. 10 of 2019. These rules apply not only to financial institutions but also to DNFBPs, such as accountants, lawyers, and real estate agents. This reflects the UAE’s commitment to international standards set by the Financial Action Task Force (FATF).

Why KYC Builds Trust

Beyond compliance, KYC builds trust. Businesses that take compliance seriously demonstrate transparency and reliability. In turn, this strengthens customer relationships and reassures regulators and investors alike.

Why KYC Compliance is Critical for UAE Businesses

Risks of Non-Compliance

Failing to comply with KYC and AML rules carries significant risks. Companies may face:

- Heavy fines.

- Loss of licenses.

- Damage to reputation and client trust.

- Increased scrutiny from regulators.

In 2021 alone, global AML-related fines were estimated between USD 2.2 billion and USD 2.7 billion, underscoring the seriousness of non-compliance (Ripjar, 2022; Kyckr, via Crowdfund Insider, 2022).

Benefits of Strong KYC Systems

By contrast, businesses with robust KYC frameworks enjoy:

- Faster and smoother customer onboarding.

- Stronger relationships with regulators and clients.

- Enhanced resilience against financial crime.

- Long-term stability and growth.

For UAE businesses, the choice is clear: investing in compliance protects against penalties while boosting credibility in a competitive market.

KYC Documents Explained: A Complete Guide for Compliance Success

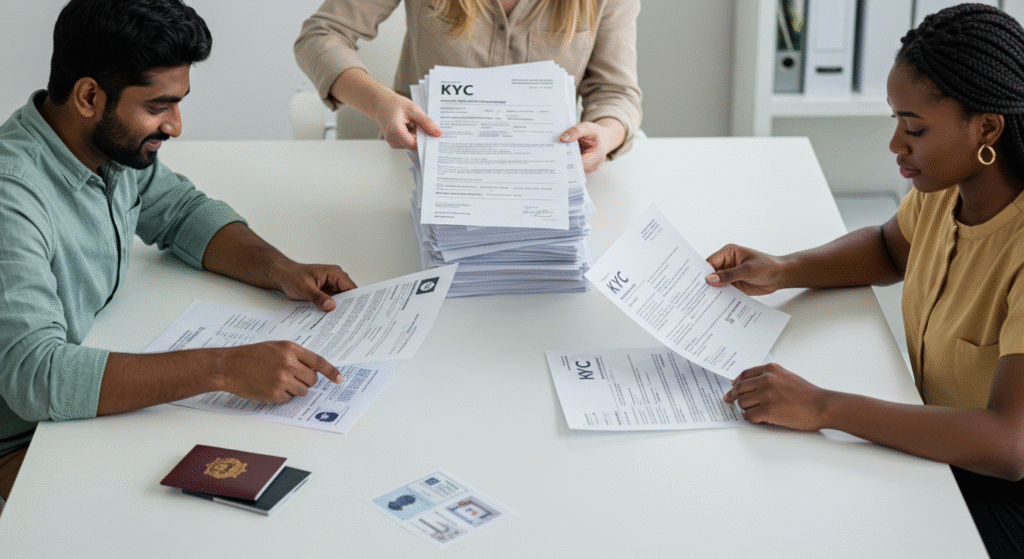

Types of KYC Documents Required in the UAE

To comply with UAE rules, businesses must collect and verify a range of KYC documents:

- Identity documents: Emirates ID, passport, or visa.

- Address documents: utility bills, tenancy contracts, or bank statements.

- Business documents: trade licenses, incorporation certificates, or Articles of Association for corporate clients.

These documents form the backbone of risk assessment, helping businesses evaluate customer profiles accurately.

KYC Documents for Individuals vs. Corporates

The requirements differ depending on whether the client is an individual or a company:

- Individuals: need government-issued IDs, proof of residence, and sometimes income verification.

- Corporates: must provide business registration documents, shareholder information, and proof of beneficial ownership.

For DNFBPs such as real estate agents and law firms, additional documentation may apply based on risk exposure.

Common Mistakes to Avoid in Documentation

Even businesses with good intentions often make mistakes in handling KYC documents. Common pitfalls include:

- Submitting outdated or expired documents.

- Incomplete recordkeeping.

- Lack of clear verification processes.

Such errors can lead to regulatory breaches and increase vulnerability to financial crime.

Best Practices for KYC Document Management

To avoid these issues, businesses should:

- Update customer records regularly.

- Adopt digital KYC solutions to streamline verification.

- Train staff on document handling and escalation procedures.

According to Deloitte’s KYC Flow technology, RegTech tools can enhance data quality, traceability, and process efficiency, while maintaining secure audit controls in KYC workflows. These innovations contribute to more accurate and robust compliance operations.”

Key KYC Documents by Customer Type

| Customer Type | Required KYC Documents | Purpose / Verification Use |

| Individual Clients | Passport, Emirates ID, Utility Bill / Proof of Address | Confirms identity, nationality, and residential address |

| Corporate Clients | Trade License, Certificate of Incorporation, Memorandum & Articles of Association, Shareholder Register | Verifies business legitimacy, ownership structure, and beneficial owners |

| Financial Institutions | Regulatory License, Board Resolution, Authorized Signatories List | Ensures the institution is legally authorized and operating within compliance |

| High-Risk Clients (PEPs, Cross-Border) | Enhanced Due Diligence (EDD) docs, Source of Funds, Source of Wealth statements | Mitigates risk of money laundering, terrorism financing, or corruption exposure |

Building Strong AML & KYC Compliance Programs Tailored for UAE Businesses

Core Elements of an Effective Program

An effective AML and KYC compliance program goes beyond document collection. It includes:

- Clear internal policies.

- Risk-based approaches to customer due diligence.

- Regular independent audits and risk assessments.

- Continuous staff training.

This structured approach ensures compliance programs remain strong even as regulations evolve.

How Advisory Services Strengthen Compliance

Many businesses find it challenging to keep up with changing regulatory requirements. This is where specialized advisory firms add value. By working with experts, businesses gain:

- Customized compliance frameworks designed for their industry.

- Independent reviews that highlight gaps before regulators do.

- Practical staff training tailored to the UAE regulatory landscape.

The Role of Technology in Simplifying Compliance

Automation tools and AI can improve transaction monitoring, flagging unusual activity in real time. Digital platforms also simplify document storage and retrieval, ensuring that businesses can demonstrate compliance when regulators ask.

Client-Centric Compliance Solutions from Mukhtara Compliance

At Mukhtara Compliance, we understand the unique regulatory landscape of the UAE. Our team brings deep expertise in AML and KYC frameworks, helping businesses of all sizes—from financial institutions to DNFBPs—design and maintain programs that meet global standards.

Services Offered

- AML & KYC framework design.

- Independent compliance audits.

- Ongoing monitoring and reporting.

- Staff training and awareness sessions.

- ESG and sustainability advisory for businesses expanding their governance focus.

By partnering with us, businesses gain more than compliance—they gain confidence.

Conclusion & Call to Action

KYC is more than a legal requirement. It is a safeguard that protects businesses, builds trust, and positions companies for long-term success in the UAE’s competitive market. From understanding what KYC means to managing the required documents and implementing a full AML program, compliance is a journey that no business can afford to ignore.

At Mukhtara Compliance, we help businesses transform that journey into a strategic advantage. Whether you are a financial institution, a DNFBP, or a growing SME, our tailored compliance services ensure you stay aligned with UAE laws and FATF standards.

Take the next step today—contact Mukhtara Compliance to safeguard your business with a customized AML and KYC compliance program.

Frequently Asked Questions (FAQ)

Q1. What are KYC documents in the UAE?

KYC (Know Your Customer) documents are official papers such as passports, Emirates IDs, trade licenses, or proof of address that businesses must collect to verify client identity and comply with UAE anti-money laundering (AML) regulations.

Q2. Who needs to submit KYC documents?

Both individual clients and businesses are required to submit KYC documents when opening bank accounts, engaging in financial transactions, or working with Designated Non-Financial Businesses and Professions (DNFBPs) in the UAE.

Q3. How often should KYC documents be updated?

KYC documents must be updated periodically, usually every 1–3 years, or when there are changes in ownership, address, or client risk profile.

Q4. Are digital KYC documents accepted in the UAE?

Yes. With the growth of RegTech solutions, digital KYC processes and e-verification are increasingly recognized, provided they comply with UAE Central Bank and Ministry of Economy guidelines.

Q5. What happens if a business fails to collect KYC documents?

Non-compliance can result in heavy fines, reputational damage, or even license suspension under UAE AML/CFT regulations.

Learn more about Regulatory Compliance by visiting these links:

– Why Understanding What Is Compliance in AML/KYC Is Vital

– Understanding KYC & AML: Risk Assessment Steps That Safeguard Your Business

– Guide to UAE Financial Crime Regulations

– How Can Regulatory Compliance Benefit from RegTech and Compliance Automation?

– What is Regulatory Compliance? A Beginner’s Guide for Businesses